Help & FAQs

What is KYC/AML?

In order to invest through CoinList, you need to pass identity verification and KYC/AML (Know Your Customer/Anti-Money Laundering) checks. These checks apply equally to U.S. and non-U.S. residents. In general, you will need to provide name, address, a selfie, and government-issued ID image.

You can learn more about KYC/AML here.

What are the risks of purchasing virtual currencies?

- virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to Federal Deposit Insurance Corporation or Securities Investor Protection Corporation protections;

- legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of virtual currency;

- transactions in virtual currency may be irreversible, and, accordingly, losses due to fraudulent or accidental transactions may not be recoverable;

- some virtual currency transactions shall be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that the customer initiates the transaction;

- the value of virtual currency may be derived from the continued willingness of market participants to exchange fiat currency for virtual currency, which may result in the potential for permanent and total loss of value of a particular virtual currency should the market for that virtual currency disappear;

- there is no assurance that a person who accepts a virtual currency as payment today will continue to do so in the future;

- the volatility and unpredictability of the price of virtual currency relative to fiat currency may result in significant loss over a short period of time;

- the nature of virtual currency may lead to an increased risk of fraud or cyber attack;

- the nature of virtual currency means that any technological difficulties experienced by the licensee may prevent the access or use of a customer’s virtual currency; and

- any bond or trust account maintained by the licensee for the benefit of its customers may not be sufficient to cover all losses incurred by customers.

How will the token sale work?

In order to be eligible to participate in the Aligned Token Sale, users must fund their CoinList Wallet with the minimum purchase amount ($100 in USDC or USDT) as well as pass KYC verification.

Once the sale begins, users will be prompted to submit a purchase request, with a limit set between $100.00 and $480,000.00. You can not submit a purchase request that is larger than the amount of USDC or USDT that you hold on CoinList.

Allocations will be selected on a first come, first served basis. Karma tiers will not have an effect on allocation selection for the Aligned Token Sale. Any user who submits a purchase after the supply is exhausted will receive their funds back in their CoinList Wallet within 48 hours of the conclusion of the sale.

What is an accredited investor?

Accredited investors meet standards defined by the US Securities and Exchange Commission which allow them to invest in certain private securities offerings. Most startups raising money do so from accredited investors only.

The SEC web site contains the full definition. In general, any of the following would meet the standard:

- Individuals with annual income over $200K (individually) or $300K (with spouse) over the last 2 years and an expectation of the same this year

- Individuals with net assets over $1 million, excluding the primary residence (unless more is owed on the mortgage than the residence is worth)

- An institution with over $5 million in assets, such as a venture fund or a trust

- An entity made up entirely of accredited investors

Verify your identity

CoinList requires all accounts to complete identity verification for legal compliance and fraud prevention. Your CoinList account will be limited from certain activities on the platform until your identity has been successfully verified.

How do I start verifying my identity?

When creating a CoinList account, you will be asked to start the identity verification process during the account setup steps. This is a requirement for all new users creating a CoinList account and you will not be able to continue to the platform until this has been completed and your identity has been verified. If you already have a CoinList account but have not verified your identity yet, you will be prompted to start your identity verification on your dashboard.

During this process, you may need to provide sensitive information including but not limited to name, address, a government-issued ID, and a selfie. Read more about our Privacy Policy.

Why was my identity not verified?

If your identity was not verified, it was because either you live in one of our unsupported countries & states where CoinList is not available at this time, or because your information that was processed for review did not pass one or more identity verification and KYC/AML (Know Your Customer/Anti-Money Laundering) checks. We do these checks to protect CoinList and our community from fraudulent users. You can learn more about KYC/AML in our Terms of Service.

If you are facing any issues with the verification process, do not attempt to create a new account using a different email address to re-try verification. Attempting to create a second account is in violation of our Terms of Service; Any violation of the Terms of Service may result in indefinite suspension of services and closure of a user's account. Instead, if you believe there was a mistake in your identity verification, submit a support ticket.

New Device Approval

Approve a New Device

CoinList requires that you approve a new device before you can access your account.

- You will also be prompted to reapprove your device if you:

- Clear the cache and cookies from your browser,

- Are using your browser's "private browsing" or "incognito" mode,

- Are using a VPN service or encrypted network,

- Log in to your account on a new device or browser.

To approve a device, start by logging into your account and entering your 6-digit authentication code. You will then be directed to a page informing you that CoinList has sent you an email. Access that email with the subject line “Approve your new device to log in” on the same device and browser. Click the Approve this device button in the email and you will be directed to your account.

This approval process must be started and completed on the same device, same browser, and at the same location.

It may take up to 10 minutes to receive this email. If you attempt to log in again, you may receive more than one email. Only the most recent new device approval email will be valid. If you do not receive the email, check your spam and other subfolders. You can whitelist emails from CoinList (team@coinlist.co) to prevent them from being flagged in the future.

You can watch the New Device Approval process here.

Step By Step Instructions to Approve a New Device

When you log into your CoinList account from a new device, you will be prompted to follow these steps.

Step 1

Log in to your CoinList account and enter your 6-digit authentication code.

Step 2

You will be directed to an “Approve new device” page informing you that CoinList has sent you an email.

Step 3

Access this email from the same device, browser, and location. Upon opening the email, click the “Approve this device” button at the bottom.

Step 4

You will be directed to your account where you are now logged in.

Trouble Approving a New Device

Troubleshooting Steps for the CoinList App

Below are some steps you can take to troubleshoot the issue you are experiencing with approving a new device.

- Make sure you are accessing your email from the same device and web browser you are using to log in to your CoinList account.

- You may be able to copy the link from the "Approve your device" button and paste it into the same browser.

- Make sure you are clicking on the most recent "New device approval" email that is sent after your log in attempt.

Additional Troubleshooting

If you did not receive the “New device approval” email, check your spam and other subfolders. You may whitelist emails from CoinList to prevent them from being flagged in the future.

After clicking the “Approve this device” button, wait at least 10 minutes to receive the approval email before clicking the button again. Only the most recent device approval email will be valid.

If you are having issues with device approval, do not create a new account. Attempting to create a second account is in violation of our Terms of Service. Any violation of the Terms of Service may result in an indefinite suspension of services and closure of a user's account.

If you're still having trouble approving a new device, please submit a support ticket.

How do I show accreditation based on crypto assets?

In order to fulfill the accreditation requirements with your crypto-asset holdings, you can either

- Upload a screenshot from a credible cryptocurrency exchange or wallet showing holdings & valuations worth over $1MM USD. The screenshot should include the date and evidence tying the investor to the account (e.g. your name or the investing entity's name), or

- Upload a message cryptographically signed using the private key of your wallet or wallets, proving that you own assets worth over $1MM USD.

In either case, you will also need to provide documentation of your debts (e.g. via a credit report or letter from your accountant) in order to qualify.

Detailed instructions for preparing a signed message

1. Prepare the following message for signature:

I, <Signatory Name>, certify under penalty of perjury that <Investing Entity Name> is the sole owner of the cryptocurrency address associated with this message as of <Today's Date>.

Replace the angle brackets with your name, the name of the investing entity, and the date.

2a. Signing the message - ETH

For Ether, use MyEtherWallet's message signing tool

Paste the message into the text field.

Select your wallet provider. (In this example, we use MetaMask.)

Click 'Connect'. Then, click 'Sign Message' to sign and approve the transaction. (There is no cost.)

Here is an example signed message:

2b. Signing the message - BTC

For Bitcoin, most wallets implement the ability to sign a message with your Bitcoin address’ private key. See this tutorial about how to sign a messaging with a blockchain.info wallet. See here for Jaxx wallet.

3. Submitting

Create a document with the message you signed, address, and message signature (sample information provided below):

A. Message:

I, John Smith, certify under penalty of perjury that I am the sole owner of the cryptocurrency address associated with this message as of Dec. 13, 2017.

B. Address

1UsRE3sak3u7qNaQ8Y1X4UmQS93qruLMt

C. Signature

IEXlF8laYLp1ZdQbIxWcXvQdt7d/0TyKLqKMNoTdpqCXG7LLm6upe4wjl6q9ZAtHc4paw9LqP8CudBNyOEwt1mo=

You can upload this information via the CoinList sale registration process or log a support ticket in our Support Center.

In the event that your funds are spread across multiple wallets, you will need to include a signed message from each address.

Also, remember to provide documentation of your debts (e.g. via a credit report or letter from your accountant).

KYC

What is KYC/AML?

In order to invest through CoinList, you need to pass identity verification and KYC/AML (Know Your Customer/Anti-Money Laundering) checks. These checks apply equally to U.S. and non-U.S. residents. In general, you will need to provide name, address, a selfie, and government-issued ID image.

You can learn more about KYC/AML here.

Compliance

What are the risks of purchasing virtual currencies?

- virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to Federal Deposit Insurance Corporation or Securities Investor Protection Corporation protections;

- legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of virtual currency;

- transactions in virtual currency may be irreversible, and, accordingly, losses due to fraudulent or accidental transactions may not be recoverable;

- some virtual currency transactions shall be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that the customer initiates the transaction;

- the value of virtual currency may be derived from the continued willingness of market participants to exchange fiat currency for virtual currency, which may result in the potential for permanent and total loss of value of a particular virtual currency should the market for that virtual currency disappear;

- there is no assurance that a person who accepts a virtual currency as payment today will continue to do so in the future;

- the volatility and unpredictability of the price of virtual currency relative to fiat currency may result in significant loss over a short period of time;

- the nature of virtual currency may lead to an increased risk of fraud or cyber attack;

- the nature of virtual currency means that any technological difficulties experienced by the licensee may prevent the access or use of a customer’s virtual currency; and

- any bond or trust account maintained by the licensee for the benefit of its customers may not be sufficient to cover all losses incurred by customers.

Aligned Token Sale

How will the token sale work?

In order to be eligible to participate in the Aligned Token Sale, users must fund their CoinList Wallet with the minimum purchase amount ($100 in USDC or USDT) as well as pass KYC verification.

Once the sale begins, users will be prompted to submit a purchase request, with a limit set between $100.00 and $480,000.00. You can not submit a purchase request that is larger than the amount of USDC or USDT that you hold on CoinList.

Allocations will be selected on a first come, first served basis. Karma tiers will not have an effect on allocation selection for the Aligned Token Sale. Any user who submits a purchase after the supply is exhausted will receive their funds back in their CoinList Wallet within 48 hours of the conclusion of the sale.

What is the lock-up schedule for the Aligned Layer Token Sale?

- Option 1: 10% unlock on the exchange listing date expected during Q1 2025, followed by a 12-month linear unlock for the remainder of the tokens

- Option 2: 25% unlock on the exchange listing date expected during Q1 2025, followed by a 6-month linear unlock for the remainder of the tokens

How do I fund my purchase?

We will display payment information when you complete your registration for the Aligned Token Sale. Eligible purchasers can pay with Tether (“USDT”) or USD Coin (“USDC”). Payments made in USDT or USDC will equate to the value of one United States Dollar ("USD") regardless of fluctuations in USDT or USDC.

There are no fees associated with purchasing tokens with USDC or USDT. You can deposit USDC and USDT into your CoinList Wallet anytime athttps://coinlist.co/wallets.

Why can’t certain residents and citizens participate in the Aligned Layer Token Sale?

CoinList is committed to following all applicable regulatory guidelines. As a result, CoinList will not be able to offer ALIGN tokens for purchase during the Aligned Token Sale to prospective participants in the United States (and its territories), Canada, China, as well as other unsupported jurisdictions.

When do I need to fund my purchase?

In order to participate in the Aligned Token Sale, users will need to fund their CoinList Wallet with the minimum purchase amount ($100 in USDC or USDT). There is no pre-funding deadline, but users will need their funds in their CoinList wallet to submit a purchase request in a timely fashion as allocations are determined on a first come, first serve basis.

Investors

What is an accredited investor?

Accredited investors meet standards defined by the US Securities and Exchange Commission which allow them to invest in certain private securities offerings. Most startups raising money do so from accredited investors only.

The SEC web site contains the full definition. In general, any of the following would meet the standard:

- Individuals with annual income over $200K (individually) or $300K (with spouse) over the last 2 years and an expectation of the same this year

- Individuals with net assets over $1 million, excluding the primary residence (unless more is owed on the mortgage than the residence is worth)

- An institution with over $5 million in assets, such as a venture fund or a trust

- An entity made up entirely of accredited investors

How do I show accreditation based on crypto assets?

In order to fulfill the accreditation requirements with your crypto-asset holdings, you can either

- Upload a screenshot from a credible cryptocurrency exchange or wallet showing holdings & valuations worth over $1MM USD. The screenshot should include the date and evidence tying the investor to the account (e.g. your name or the investing entity's name), or

- Upload a message cryptographically signed using the private key of your wallet or wallets, proving that you own assets worth over $1MM USD.

In either case, you will also need to provide documentation of your debts (e.g. via a credit report or letter from your accountant) in order to qualify.

Detailed instructions for preparing a signed message

1. Prepare the following message for signature:

I, <Signatory Name>, certify under penalty of perjury that <Investing Entity Name> is the sole owner of the cryptocurrency address associated with this message as of <Today's Date>.

Replace the angle brackets with your name, the name of the investing entity, and the date.

2a. Signing the message - ETH

For Ether, use MyEtherWallet's message signing tool

Paste the message into the text field.

Select your wallet provider. (In this example, we use MetaMask.)

Click 'Connect'. Then, click 'Sign Message' to sign and approve the transaction. (There is no cost.)

Here is an example signed message:

2b. Signing the message - BTC

For Bitcoin, most wallets implement the ability to sign a message with your Bitcoin address’ private key. See this tutorial about how to sign a messaging with a blockchain.info wallet. See here for Jaxx wallet.

3. Submitting

Create a document with the message you signed, address, and message signature (sample information provided below):

A. Message:

I, John Smith, certify under penalty of perjury that I am the sole owner of the cryptocurrency address associated with this message as of Dec. 13, 2017.

B. Address

1UsRE3sak3u7qNaQ8Y1X4UmQS93qruLMt

C. Signature

IEXlF8laYLp1ZdQbIxWcXvQdt7d/0TyKLqKMNoTdpqCXG7LLm6upe4wjl6q9ZAtHc4paw9LqP8CudBNyOEwt1mo=

You can upload this information via the CoinList sale registration process or log a support ticket in our Support Center.

In the event that your funds are spread across multiple wallets, you will need to include a signed message from each address.

Also, remember to provide documentation of your debts (e.g. via a credit report or letter from your accountant).

Getting started with CoinList

Verify your identity

CoinList requires all accounts to complete identity verification for legal compliance and fraud prevention. Your CoinList account will be limited from certain activities on the platform until your identity has been successfully verified.

How do I start verifying my identity?

When creating a CoinList account, you will be asked to start the identity verification process during the account setup steps. This is a requirement for all new users creating a CoinList account and you will not be able to continue to the platform until this has been completed and your identity has been verified. If you already have a CoinList account but have not verified your identity yet, you will be prompted to start your identity verification on your dashboard.

During this process, you may need to provide sensitive information including but not limited to name, address, a government-issued ID, and a selfie. Read more about our Privacy Policy.

Why was my identity not verified?

If your identity was not verified, it was because either you live in one of our unsupported countries & states where CoinList is not available at this time, or because your information that was processed for review did not pass one or more identity verification and KYC/AML (Know Your Customer/Anti-Money Laundering) checks. We do these checks to protect CoinList and our community from fraudulent users. You can learn more about KYC/AML in our Terms of Service.

If you are facing any issues with the verification process, do not attempt to create a new account using a different email address to re-try verification. Attempting to create a second account is in violation of our Terms of Service; Any violation of the Terms of Service may result in indefinite suspension of services and closure of a user's account. Instead, if you believe there was a mistake in your identity verification, submit a support ticket.

Managing my account

New Device Approval

Approve a New Device

CoinList requires that you approve a new device before you can access your account.

- You will also be prompted to reapprove your device if you:

- Clear the cache and cookies from your browser,

- Are using your browser's "private browsing" or "incognito" mode,

- Are using a VPN service or encrypted network,

- Log in to your account on a new device or browser.

To approve a device, start by logging into your account and entering your 6-digit authentication code. You will then be directed to a page informing you that CoinList has sent you an email. Access that email with the subject line “Approve your new device to log in” on the same device and browser. Click the Approve this device button in the email and you will be directed to your account.

This approval process must be started and completed on the same device, same browser, and at the same location.

It may take up to 10 minutes to receive this email. If you attempt to log in again, you may receive more than one email. Only the most recent new device approval email will be valid. If you do not receive the email, check your spam and other subfolders. You can whitelist emails from CoinList (team@coinlist.co) to prevent them from being flagged in the future.

You can watch the New Device Approval process here.

Step By Step Instructions to Approve a New Device

When you log into your CoinList account from a new device, you will be prompted to follow these steps.

Step 1

Log in to your CoinList account and enter your 6-digit authentication code.

Step 2

You will be directed to an “Approve new device” page informing you that CoinList has sent you an email.

Step 3

Access this email from the same device, browser, and location. Upon opening the email, click the “Approve this device” button at the bottom.

Step 4

You will be directed to your account where you are now logged in.

Trouble Approving a New Device

Troubleshooting Steps for the CoinList App

Below are some steps you can take to troubleshoot the issue you are experiencing with approving a new device.

- Make sure you are accessing your email from the same device and web browser you are using to log in to your CoinList account.

- You may be able to copy the link from the "Approve your device" button and paste it into the same browser.

- Make sure you are clicking on the most recent "New device approval" email that is sent after your log in attempt.

Additional Troubleshooting

If you did not receive the “New device approval” email, check your spam and other subfolders. You may whitelist emails from CoinList to prevent them from being flagged in the future.

After clicking the “Approve this device” button, wait at least 10 minutes to receive the approval email before clicking the button again. Only the most recent device approval email will be valid.

If you are having issues with device approval, do not create a new account. Attempting to create a second account is in violation of our Terms of Service. Any violation of the Terms of Service may result in an indefinite suspension of services and closure of a user's account.

If you're still having trouble approving a new device, please submit a support ticket.

Nomad Wallet Link

How do I link a wallet for Nomad Recovery?

Following KYC verification, you will be prompted to link one or more of your Ethereum wallets using a Metamask or WalletConnect browser extension. The wallet address that you link MUST be the same address that you bridge assets back from (e.g., users with address "0x123...abc" on Evmos can only bridge back to "0x12...abc" on Ethereum - the sending wallet address and receiving wallet address must be the same).

Please note that Wallet Link does not currently support multisig/smart contract wallets. If you are a DAO or individual needing to link a multisig wallet to your KYC’d identity, please reach out to nomad-recovery@coinlist.co from your Coinlist-associated email and we’ll be more than happy to assist.

Do I need to KYC verify in order to be considered by Nomad for the recovery effort?

Yes. You are required to successfully complete KYC and link/verify an eligible wallet address in order to be considered by Nomad for the recovery effort. If you are using an existing CoinList account and have already KYC-verified on our platform, there is no need to resubmit an application - you will be taken directly to the wallet linking step.

Wallets

Sending Funds to an Incorrect Address or Chain

Which blockchains and assets are supported by CoinList?

Ethereum (ERC20) | ETH, USDT, USDC, USDE, TUSD, TBTC, DAI, WBTC, PAX, OXT, LINK, POL(formerly MATIC), COMP, SKL, UNI, OCEAN, NU, NYM, IMX, BAL, RLY, EFI, AAVE, CQT, HMT, EFIL, BZZ, VEGA, BTRST, CLV, WAXL, CYBER, FLIP, ONDO, ZETA, WLD, ENJ, MASA, TST, MSN, XZK, MOCA, CXT, KARATE, PEPE, SHIB, G, TRIBL, ENA, PLAY, MOG, ZKL, SPX, LBTC, weETH, wstETH, ETHFI, KING, OBOL, BDXN, BTR, SKY, CFG, ENSO, NIL |

Algorand | ALGO |

Agoric | BLD |

Bitcoin | BTC |

Celo | CELO, CUSD |

Casper | CSPR |

Dogecoin | DOGE |

Polkadot | DOT |

Filecoin | FIL |

Dfinity | ICP |

Mina | MINA |

Oasis | ROSE |

Sei | SEI |

Solana | NEON, SOL, NATIX, MOTHER, POPCAT, WIF, MEW, TRUMP, MELANIA, GIGA, PENGU, PUMP, 2Z, PIPE |

Stacks | STX |

Sui | SUI |

Tezos | XTZ |

Avalanche (C-Chain) | AVAX |

Axelar | AXL |

Polygon | BCUT |

Artbitrum | SQD |

| Peaq | PEAQ |

| Binance Smart Chain (BSC) | wROSE |

| Optimism EVM | WCT |

| ZCash | ZEC |

| Cardano | ADA |

| Base | FLK, TRUST |

Do not send funds in to CoinList via any other chain that is not supported, such as BEP20 or TRC20. If you do this you risk losing your funds.

For ZCash (ZEC) deposits and withdrawals, we only support transparent addresses (t). Do not send ZEC to or from a shielded address (z). If you do this you risk losing your funds. ZEC deposit address may not be recognised by other exchanges. Always verify compatibility before initiating a transfer.

Can my funds be recovered if I send tokens from an unsupported network?

We may be unable to perform a recovery of funds sent via the incorrect network. If we are able to recover the funds, there will be a charged fee. Please see our fee page for more information.

Please do not trust previous transactions you have made as a source for your deposit address. CoinList and other exchanges may update and change the receiving address on your account after it has been used.

Withdrew funds to the incorrect address?

Once you have confirmed a withdrawal from your CoinList account the transaction is initiated and sent to the blockchain, after this the funds are no longer on CoinList's platform. Due to the nature of blockchain these funds cannot be reversed or recovered by CoinList. If you know the end user of the address, please try and contact them for help retrieving funds.

Transactions in virtual currency may be irreversible, and, accordingly, losses due to fraudulent or accidental transactions may not be recoverable. Please see the additional risks associated to investing in and sending cryptocurrencies here.

Memo ID

CSPR deposits require a number called the "tag," "memo," or "transfer ID" to be sent with your deposit in order for funds to be credited to your account. If you deposit CSPR without it, your deposit will be lost and cannot be reclaimed.

STX and SEI deposits also require a memo ID. It may be referred to as a "memo" or "tag" on other exchanges. Only deposit using wallets that support this field. If in doubt, start with a small test deposit.

MiCA

What is the Refund Policy for EU purchasers under MiCA?

In accordance with the Markets in Crypto-Assets Regulation (“MiCA”), purchasers residing in the European Union have the right to withdraw from their purchase of their digital asset within 14 days from the purchase period.

Exclusions:

This right of withdrawal does not apply if:

- The digital asset has already been transferred to your wallet or made accessible for use before the withdrawal period expires, with your prior consent.

- The purchase falls under exceptions permitted under MiCA or other applicable regulations.

- In order to ensure the smooth completion of a time-limited offer to the public of crypto-assets, the right of withdrawal should not be exercised by retail holders after the end of the subscription period.

What does this mean?

If you’re in the EU, you may have the right to cancel your token purchase within 14 days of confirming it. But if the token sale has already ended, you can’t request a refund, even if you’re still within the 14 days.

Examples:

- Token Sale A: You registered for a sale that had a 1-week purchase window. You request a refund 10 days after confirming your purchase.

You do not have the right to request a refund since the purchase period is over.

- Token Sale B: You registered for a sale with a 2-week purchase window. You request a refund 10 days after confirming your purchase, while the purchase window is still open.

You do have the right to request a refund.

To request a refund, users must notify us in writing by sending an email to CoinList Support [support@coinlist.com] with the subject line "Refund Request – [[Token Name] Sale]" within the 14-day withdrawal period. The request must include:

- User’s full name and email address associated with your CoinList account

- A statement explicitly requesting a refund under your MiCA withdrawal right

Upon receiving a valid refund request, CoinList will process the refund to the original payment method within [3] business days.

By completing your purchase, you acknowledge and agree to this refund policy and the conditions under which it applies.

For further inquiries, please contact CoinList Support.

The Next Evolution of CoinList

What is changing at CoinList?

CoinList is going fully noncustodial and onchain. We are simplifying the product to focus on one core job: helping people access high quality token sales and receive tokens directly into wallets they control.

Instead of holding assets in CoinList custody, you will use noncustodial wallets where you hold your own keys and control your funds. Later this year, we will introduce these noncustodial wallets in partnership with Privy.

If you currently hold assets in CoinList custody, we will make migrating them simple and safe.

You will receive emails about product changes that affect you, and we will keep our Next Evolution of CoinList Help Center articles updated as new features roll out.

For more information, please see our blog post “The Next Evolution of CoinList.”

What happens to my pending token unlocks and distributions?

We are reviewing the best path for future token unlocks and distributions as we move toward a non custodial model. Our primary focus is to ensure a smooth and secure process for users who are still awaiting tokens. Every user will receive the tokens they are entitled to.

We will provide clear instructions once the plan is finalized.

What does “fully noncustodial and onchain” mean?

Noncustodial means you control your wallet and your keys. Your assets sit in a wallet under your control, not in CoinList custody. CoinList does not have access to your funds.

Onchain means token sales, distributions, trading, and other activity will happen directly on public blockchains instead of inside a centralized custodial platform.

In short, you hold your own keys and stay in control of your assets at all times. For more context, see our blog post “The Next Evolution of CoinList”.

What is happening to my USD balance on CoinList?

As shared in our recent announcement, CoinList is moving to a fully non custodial, onchain model. As part of this transition USD balances will no longer be supported.

We will automatically convert your remaining USD balance to USDC at no cost. Conversions will start on November 25, 2025 and finalize by December 1, 2025.

If you currently hold USD in CoinList custodial wallets:

-

You do not need to submit a request for this conversion.

-

You will receive a notification once your USD has been converted to USDC.

-

You will be able to transfer your USDC to your new self-custodial wallet on CoinList in the coming weeks, once it becomes available.

-

You can also withdraw your USDC off platform at any time, today or after the transition.

For broader context on how deposits, withdrawals, trading, and other products are changing, please see our Next Evolution of CoinList Help Center articles.

The End of Custodial Staking: What You Need to Know

As shared in our recent announcement, CoinList is moving to a fully non-custodial, on-chain model.

As part of this transition, there will be several important changes to Staking and onchain offers:

- Staking and onchain offers will wind down by November 30, 2025. We’ll introduce non-custodial ways to participate in these opportunities next year.

- Final rewards for assets currently enrolled in autostaking (AXL, SOL, CSPR, SUI) and onchain offers (LBTC, USDe, weETH, wstETH) will be paid out by November 30.

What is happening to Karma?

Karma, in its current form, has been turned off. You can no longer claim new Karma or increase your Karma tier.

As we move CoinList fully onchain and non custodial, we are giving Karma a full rethink. The current program is paused while we design the next version.

We took snapshots of everyone’s Karma history and tiers.

This means:

• Your past Karma activity and tier have been saved.

• Your Karma Score is not lost, even though claiming is no longer available.

The snapshot preserves your history so it can be used in the future if needed.

We are rethinking Karma for the new onchain CoinList experience. The team is already working on what comes next, and we expect big updates next year.

We will share details about the future of Karma, and how the snapshots of your Karma history and tier may be used, in a future announcement and in our Help Center.

Unsupported Assets for Withdrawal

As shared in our recent announcement, CoinList moved to a fully non-custodial, onchain model.

Due to this transition, withdrawals from old CoinList are not available for the following assets:

0G, AERO, APT, ASTER, AVNT, BNB, BONK, EFI, EFIL, ENJ, FLOW, HYPE, JUP, KMNO, MET, PYTH, S, TAO, XLM, XPL, XRP, ZRO.

Starting November 30, 2025, any remaining balances in these assets held in your CoinList wallet will be automatically converted to USDC on your behalf.

Conversions are being processed in batches. As a result, your balance may update at a different time than other users or other assets.

What are the custody fees?

As shared in our November announcement, CoinList is going fully non-custodial and onchain.

Starting April 1, we will begin charging a monthly custody fee on all accounts with custodial balances (balances on https://old.coinlist.co). Non-custodial wallets will not have a fee.

- The monthly custody fee will be $5 or 10 bps (0.1%) of your total account value, whichever is greater.

- Withdrawals remain open, and we encourage you to transfer supported assets to your new CoinList non-custodial wallet (or to other providers) to avoid paying custody fees.

- In July, we will begin automatically migrating all supported assets to your non-custodial wallet.

- In July, any unsupported assets will be liquidated to USDC and migrated to your non-custodial wallet. Due to limitations around market liquidity for these assets, it may take some time to fully exit these positions. During this time, you will not be able to withdraw those assets. If you want to avoid having your tokens liquidated, please withdraw them now.

- Vesting tokens will also be transitioned to your non-custodial wallet. If you are receiving token distributions on a regular schedule, you will receive an email when this happens. Custody fees will not be taken from unvested tokens.

In case you don't have enough to withdraw your assets, trading, conversion and deposits are no longer available. Custody fees apply to any custodial balances, including small balances that remain in the account. Withdrawals are only available if the balance meets the minimum withdrawal amount for that asset. If your remaining balance is below that minimum, it cannot be withdrawn.

If the balance remains in your custodial account after custody fees begin, the fee will gradually reduce the balance over time until it reaches zero. It will not create a negative balance.

What happens if my balance is below the minimum withdrawal amount?

Withdrawals must meet both the minimum withdrawal amount and the required network fee. If the balance of the asset you are attempting to withdraw is below the minimum withdrawal threshold, it cannot be withdrawn. You can review the minimum withdrawal amounts here. This requirement applies to all assets on CoinList.

As part of our transition to a non-custodial model, trading and conversions are no longer available. This means you cannot add to or convert assets on CoinList to meet the minimum withdrawal requirement.

Will Fees apply to these withdrawals?

If the balance remains in your custodial account after custody fees begin, the fee will gradually reduce the balance over time until it reaches zero. It will not create a negative balance.

Trading and Conversion on CoinList: What You Need to Know

As shared in our recent announcement, CoinList transitioned to a fully non-custodial, on-chain model. Trading and conversion features are no longer available.

Withdrawals remain open, and we encourage you to transfer supported assets to your new CoinList non-custodial wallet (or to other providers) to avoid paying custody fees.

For more information on how Trading, Staking, and other products are affected, please refer to our Next Evolution of CoinList Help Articles.

Rainbow Token Sale

How will the token sale work?

In order to be eligible to participate in the Rainbow Token Sale, users must pass KYC verification and have an external non-custodial wallet address to fund their purchase request.

Once the purchase period begins, users will be prompted to submit a purchase request, with a minimum purchase of $100.00. You will not be able to submit a purchase request that is larger than the amount of USDC or USDT that you hold in your external wallet.

After the purchase period closes, December 18, 2025 at 17:00 UTC, allocations will be selected based on the ‘Filling from the Bottom” allocation method. Users will be informed of the final allocations within 5 business days of December 18, 2025 at 17:00 UTC.

Users who are not selected to receive an allocation will receive their funds back in their funding wallet within 5 business days of December 18, at 17:00 UTC.

What is Rainbow?

Rainbow is a self-custodial crypto wallet that lets users securely store, send, receive, and manage digital assets directly from their own wallet, without relying on a centralized intermediary. It supports tokens, NFTs, swaps, and multiple Ethereum-based networks through a simple, user-friendly interface. With Rainbow, users always remain in full control of their private keys and onchain activity.

What is the "Filling from the Bottom" Allocation Method?

To learn more about the "Filling from the Bottom" Allocation Method, see here.

Why can’t certain residents and citizens participate in the Rainbow Token Sale?

CoinList is committed to following all applicable regulatory guidelines. As a result, CoinList will not be able to offer RNBW tokens for purchase during the Rainbow Token Sale to prospective participants in the US (and its territories), with the exception of U.S. accredited investors, Canada, and the EU (except for up to 149 natural or legal persons per Member State under MiCAR exemptions), and any individual, country, or territory subject to US, EU, UN, or UK sanctions, and certain unsupported jurisdictions.

When do I need to fund my purchase?

In order to participate in the Rainbow Token Sale, users will need to fund their purchase request with the minimum purchase amount ($100 USD worth of USDC or USDT). There is no pre-funding deadline, but users will need to fund their purchase request within the 7-day timeframe, from December 11 at 17:00 UTC to December 18 at 17:00 UTC, to be eligible for an allocation.

When can I expect to receive my funds back if I do not get an allocation?

After the purchase period closes, allocations will be selected based on the “Filling from the bottom” allocation method. Users who are not selected to receive an allocation will receive their funds back to their funding wallet within 5 business days.

How do I fund my purchase?

Eligible purchasers can fund their purchase using Tether (USDT) or USD Coin (USDC) from a non-custodial, external cryptocurrency wallet. Payments made in USDT or USDC will equate to the value of one United States Dollar (“USD”) regardless of fluctuations in USDT or USDC.

You must also have a sufficient balance of ETH in your wallet to cover Ethereum network gas fees when submitting your transaction. If your wallet does not have enough ETH for gas, your transaction will fail even if you have enough USDT or USDC to fund the purchase.

The wallet address linked during the wallet connect step will be the default wallet for payment and the wallet that receives any token distribution, regardless of which wallet ultimately sends the funds. Additional non-custodial, external wallets can be used to fund a purchase, but tokens will always be distributed to the wallet connected during the sale flow.

Please allow a few minutes for transactions to be reflected in the purchase UI after submitting payment.

Aztec

How does the Uniswap Continuous Clearing Auction work?

1. Submit a Bid

You submit a total ETH amount and a maximum price you’re willing to pay. All bids are denominated in ETH.

2. Your Bid Spreads Across All Remaining Tranches

Your total ETH is automatically split evenly across every tranche that has not yet cleared at the time you bid.

3. Each Tranche Has Its Own Supply

Tranches may have different token amounts, so the number of tokens available per tranche can vary.

4. Clearing Price Per Tranche

At the end of each tranche, the auction sets a clearing price based on total eligible demand.

- If your max price ≥ the clearing price, you receive tokens in that tranche.

- If your max price is below the clearing price, you receive none for that tranche.

5. Prices Can Only Go Up, Not Down

A tranche’s clearing price can stay the same or increase, but it cannot decrease below the previous clearing price or the auction’s floor price (if one exists).

6. Bids Cannot Be Withdrawn

Once placed, bids are not withdrawable.

- If your capped bid is outbid, you may convert any unspent ETH from that bid into a market order.

- EU participants should refer to Section 4 of the Auctions Term of Sale for refund rights and additional information.

For more information, see here.

Can I withdraw my bids and receive a refund?

Once your bids are placed, you will not be able to withdraw them. If you place a capped order bid and are outbid, you will have the option to convert your unspent ETH from this bid to a market order. For EU participants, please refer to Section 4 of the Auction Terms of Sale, for refund rights and further information.

When does the token become transferable?

After February 11th 2026 the community can pass a governance vote to make the following tokens transferable:

- Tokens purchased in the Contributor and Public track of the auction.

- Block rewards received by sequencers.

- The Uniswap V4 pool for trading.

After a successful vote, these tokens will be 100% unlocked. If the vote does not pass, the community can keep proposing votes. If the vote(s) do not pass, the tokens purchased through the sale will unlock automatically and become transferable on November 13th 2026. No other tokens can be unlocked or transferable until November 13th, 2026.

Who can participate?

Participants must be 18 years of age or older, complete applicable sanctions and wallet screening checks. U.S. citizens are eligible to participate. Access to the sale is also prohibited in and including comprehensively sanctioned jurisdictions, the UK, Malta, Myanmar, and additional jurisdictions.

What does the AZTEC Token do?

The AZTEC Token is a network token that powers the Aztec Network. The token will be used for the following functions:

Staking: Sequencers will stake tokens that serve both as sybil resistance and slashing collateral. Users can delegate tokens to a third-party operator.

Governance: Tokens enable participation in the governance of the Aztec Network.

Network fees: In the future, if enabled by governance, the tokens will serve as the means to pay for transaction fees on the network.

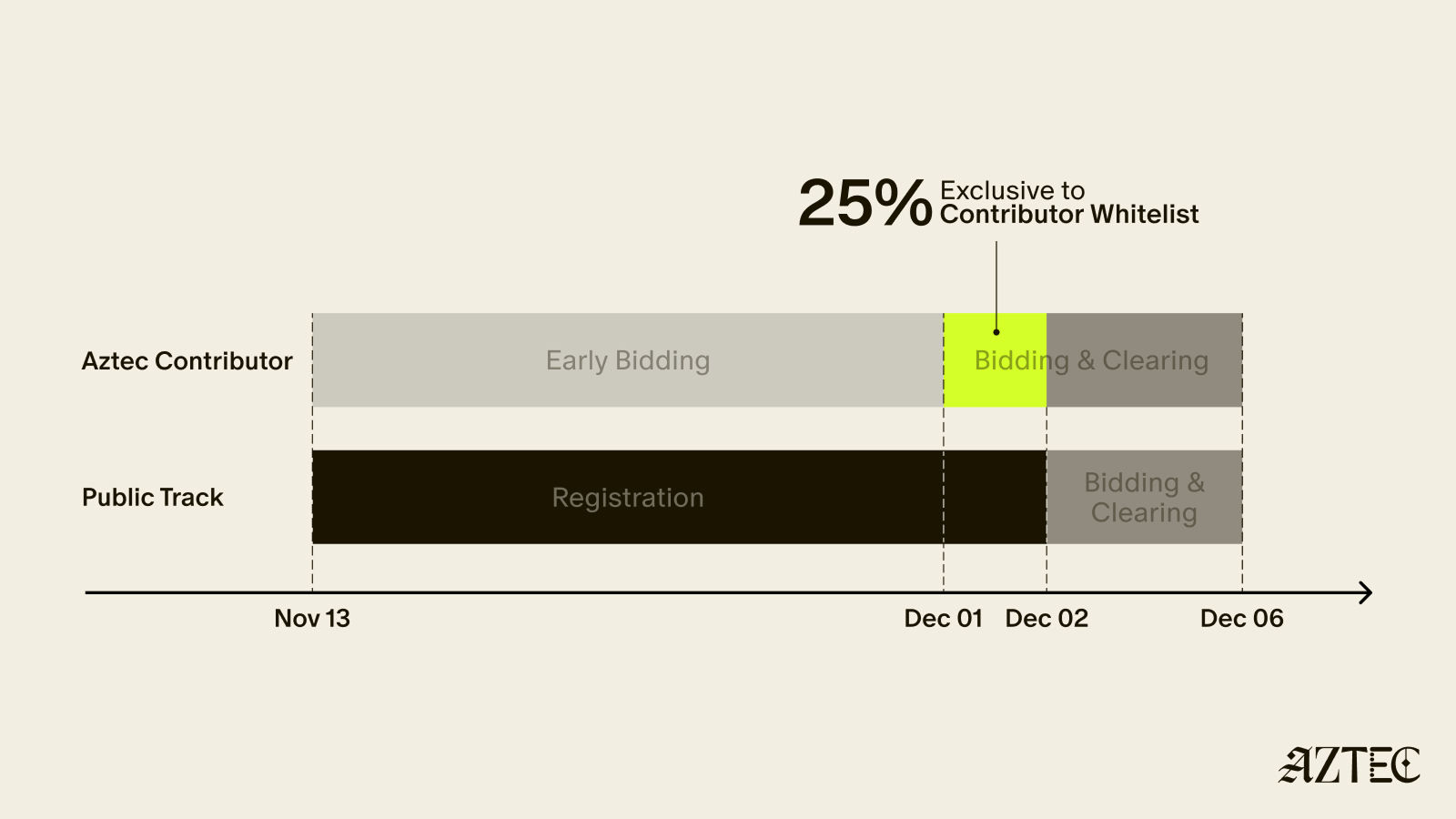

What if I'm not on the Contributor track whitelist?

To pre-qualify for bidding, mint your KYC NFT and come back on December 2nd to submit your bid. The public sale track sale will run from December 2nd, 2025, to December 6th, 2025. Aztec has calendar reminders you can set and an automated email you can sign up for to remind you when the public sale track goes live.

How will the governance work? Who can participate?

At Ignition, governance votes require the participation of 100,000,000 Tokens (~0.97% of the Total Supply). If 66,666,667 Tokens (~0.64%) vote yes, the vote will pass.

Only those who bought tokens through the Genesis sequencer sale, the Contributor sale track whitelist, and the public sale track are eligible to vote in governance.

The core team and investors can't participate in staking or governance for 12 months. Additionally, their tokens have a 36-month lockup schedule from the 13th of November 2025, consisting of 12 months locked, followed by 24 months linear unlock.

Is there a cap to the sale?

Users can either place a market order or set their own cap to ensure they never buy tokens above a certain price. As the sale is distributing a large percentage of the network (14.95%), the Continuous Clearing Auction (CCA) ensures that users will never pay more than any other user in a given period for tokens while enabling fair price discovery.

Reya Token Sale

How will the token sale work?

In order to be eligible to participate in the Reya Token Sale, users must fund their CoinList Wallet with the minimum purchase amount ($100 in USDC or USDT) as well as pass KYC verification.

Once the sale begins, users will be prompted to submit a purchase request, with a minimum purchase of $100.00. You can not submit a purchase request that is larger than the amount of USDC or USDT that you hold on CoinList.

After the purchase period closes, December 2, 2025 at 17:00 UTC, allocations will be selected based on the ‘Filling from the Bottom” allocation method. Users will be informed of the final allocations within 5 business days of December 2, 2025 at 17:00 UTC.

Users who are not selected to receive an allocation will receive their funds back in their CoinList Wallet within 5 business days of December 2, at 17:00 UTC.

When do I need to fund my purchase?

In order to participate in the Reya Token Sale, users will need to fund their CoinList Wallet with the minimum purchase amount ($100 USD worth of USDC or USDT). There is no pre-funding deadline, but users will need their funds in their CoinList wallet to submit a purchase request within the 7-day timeframe, November 25 at 17:00 UTC to December 2 at 17:00 UTC, to be eligible for an allocation.

When can I expect to receive my funds back if I do not get an allocation?

After the purchase period closes, allocations will be selected based on the “Filling from the bottom” allocation method. Users who are not selected to receive an allocation will receive their funds back to their funding wallet within 5 business days.

What is the "Filling from the Bottom" Allocation Method?

To learn more about the "Filling from the Bottom" Allocation Method, see here.

Why can’t certain residents and citizens participate in the Reya Token Sale?

CoinList is committed to following all applicable regulatory guidelines. As a result, CoinList will not be able to offer REYA tokens for purchase during the Reya Token Sale to prospective participants in the US (and its territories), Canada, and the EU (except for up to 149 natural or legal persons per Member State under MiCAR exemptions), and any individual, country, or territory subject to US, EU, UN, or UK sanctions, and certain unsupported jurisdictions.